Order-to-Cash Process Automation FAQs

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Heather Leveton

Read it in 5 minutes

1200

627

1200

627

Written by Heather Leveton

Read it in 5 minutes

Heather Leveton

Written by Bio goes here. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur eleifend ornare lectus nec porttitor. Pellentesque faucibus erat a venenatis tristique. Curabitur condimentum pellentesque justo, quis suscipit justo.

23 September 2020

For CFOs and the wider finance department, investing in a centralised Order-to-Cash process automation solution can unlock multiple benefits, from optimising company-wide efficiencies to facilitating informed decision-making, to enabling greater risk mitigation, and more.

Yet, despite UK cloud adoption rates sitting between 80% and 84%, many CFOs face barriers to adoption regarding Order-to-Cash solutions, and often, these objections stem from internal uncertainty and wariness of change. After all, it’s important to be sure your organisation will see value before investing in a solution, especially if implementing that solution will have an impact on business-wide processes.

To help your organisation overcome pushbacks and understand the value you could achieve with an Order-to-Cash process automation solution, we’ve answered four common Order-to-Cash process automation questions.

Unil recently, financial IT systems were fairly limited, primarily built to manage company finances and report on historical data. But today, they contain the infrastructure to add intelligence and deliver return across a much wider function.

“Today, finance executives are using technology to go beyond the month-end close process and the annual budgeting cycle… by providing financial experts with the proper foundation for data migration, costs, risks and time consumption, finance is able to act as a business partner.” – Thack Brown, SAP head of the line of Business Finance.

There are multiple areas where financial operations solutions can deliver ROI. For example, an Order-to-Cash automation solution will:

Of course, maintaining a secure, reliable and accurate compliant system that ensures data integrity is always an organisational priority and requirement.

Aside from understanding the benefits and potential for ROI, your organisation must be confident that any digital platform investment will be secure and reliable.

If we take Square Marble’s Mia solution as an example, this solution ensures security through a range of features:

Projects and required investment will inevitably vary, dependent on the size and complexity of a specific organisation.

A discovery workshop with your team will enable your chosen software provider to validate your requirements, timelines and to onboard you to their delivery program for successful implementation.

Milestones will enable you to plan resources with IT, project management, business process experts and end users.

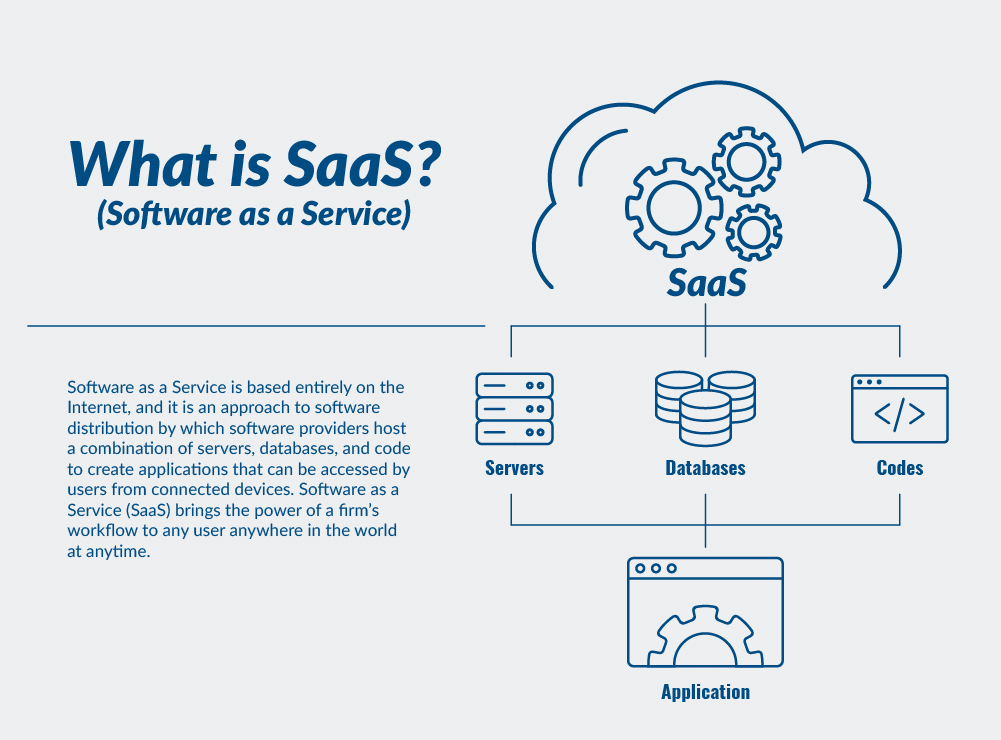

As every business case is unique, financial operations SaaS solutions investment will depend upon the size of the organisation and the complexity of the business. At the Enterprise end of the scale, prices typically start from about £4k per month.

To secure internal buy-in, it is important to understand the ROI you can achieve and the integration, resources and budget requirements you need. Armed with this information, you can be confident that an order to cash automation solution will deliver results

Text written by Richard Brown .

CRO of Global Debt Recovery & Customer Contact provider 4D Contact.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide