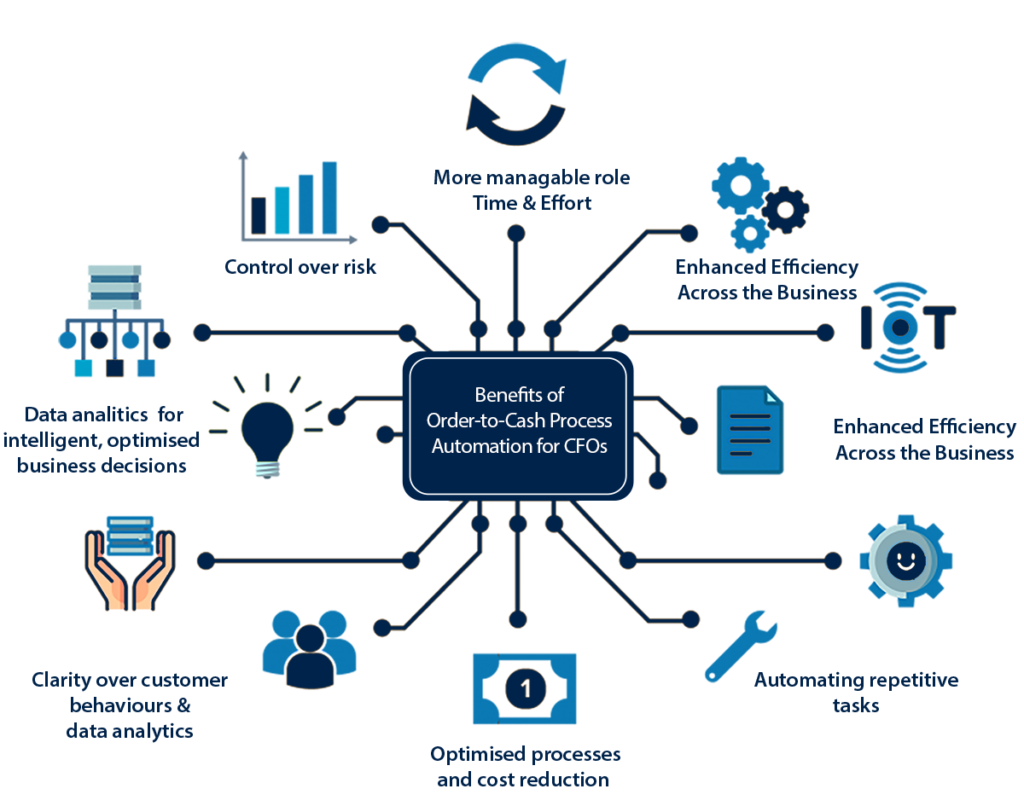

O2C Process Automation: 5 Benefits for CFOs

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Heather Leveton

Read it in 4 minutes

1200

627

1200

627

Written by Heather Leveton

Read it in 4 minutes

Heather Leveton

Written by Marketing Director of International Debt Recovery & Credit-Control provider 4D Contact. With a CV which includes Marketing and Managing Director roles within Time Warner businesses, Heather has experience in developing and implementing strategic business plans that meet financial targets and deliver long-term business growth. She played a key role in building market-leading premium TV brands such as Band of Brothers, The Sopranos and Friends in the UK and also in heading up HBO's expansion into the International home entertainment market.

7 October 2020

Financial operations technologies such as O2C process automation platforms are transforming the way modern financial teams operate. Enabling a new level of insight, analysis and transparency over legacy processes, the right O2C software solution can provide considerable benefits for CFOs.

In fact, with an agile solution in place, CFOs can gain visibility and intelligent insight over their business in a way that allows them to make strategic, data-informed, decisions that will ensure O2C processes are continually optimised; driving cost efficiencies and revenue growth.

Looking at specific benefits, by adopting an O2C process automation solution, CFOs can secure the following benefits:

For CFOs, increasing responsibilities, large volumes of hard-to-manage data, plus limited time, creates an increasingly challenging role. With a lack of clarity and no time to adjust, CFOs can find themselves in a role where it’s difficult to deliver actionable, forward-thinking insights; which can leave the business struggling to adapt or grow in changing financial markets.

Credit and collections process automation helps to clarify this complex cycle by:

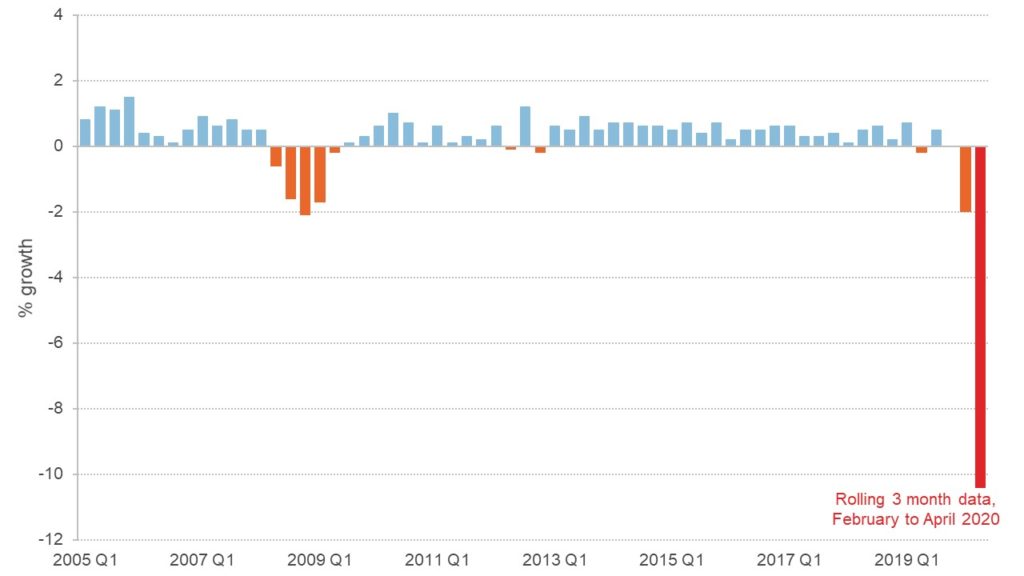

In a post-Covid world, largely forecast to see countries across the world experiencing an unprecedented recession, it has never been more important for CFOs and financial teams to have the predictive technology and tools in place to deliver a strategic, informed approach to risk management.

Order-to-cash automation solutions can help to deliver this. By enabling clarity over customer behaviours and historical data, and by generating predictive algorithms that identify opportunity and intelligently predict risk, they guard against a range of scenarios, for example, upturns or downturns in market conditions, changes in a customer’s business and more. As a result, CFOs are able to predict how to optimise potential revenue, whilst minimising bad debt risk.

Traditional legacy (typically siloed, non-digital) processes, can create substantial efficiency blocks across a business and leave teams with a lack of visibility and insight. order-to-cash automation can prevent this issue in a number of ways, by:

As a result, CFOs and the wider business can better optimise processes to drive growth and cut cost.

Increasing revenue, decreasing outgoing costs, delivering on the needs of the board, deciding on profitable investment strategies, and ensuring transparency over wider company financial performance are all priorities for CFOs.

With the right solution in place, combining real-time reporting, automation and analytics in one central platform, CFOs stand to benefit from greater visibility, insight and efficiency – so can make more informed decisions and predictions to address (and exceed) these KPIs.

Ensuring data integrity, quality and security is crucial if CFOs are to make informed decisions and implement clear business goals.

With order-to-cash digital transformation in place, this task is immediately clearer. Real-time analytics and reporting simplifies complex processes, ensuring instant, accurate and compliant insight, enabling proactive, informed decisions across the business – and of course as a result, delivering greater customer satisfaction.

With the right financial operations technology in place, CFOs are empowered to deliver the best benefits back to their business, gaining the transparency and data-driven foundations needed for greater efficiency, more actionable insight, increased profitability and enhanced risk mitigation.

Text written by Richard Brown .

CRO of Global Debt Recovery & Customer Contact provider 4D Contact.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide