UK Late Payment Reform

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Martin Kirby

Read it in 5 minutes

1200

627

1200

627

Written by Martin Kirby

Read it in 5 minutes

Martin Kirby

Written by Martin Kirby. Martin has worked within credit and risk for over 30 years, holding senior positions at organisations such as Business Stream, Kier Group, Adecco UK, and Bupa Healthcare. Martin’s exceptional leadership has earned him industry accolades, including Credit Manager of the Year and Corporate Credit Team of the Year. Martin holds an MBA from INSEAD, providing him with a global perspective on strategic finance, change leadership, and innovation.

23 October 2025

The Proposal

The government’s proposed UK late payment reform framework aims to create a culture of prompt payment and accountability. The key measures under discussion include:

- Hard cap on payment terms:

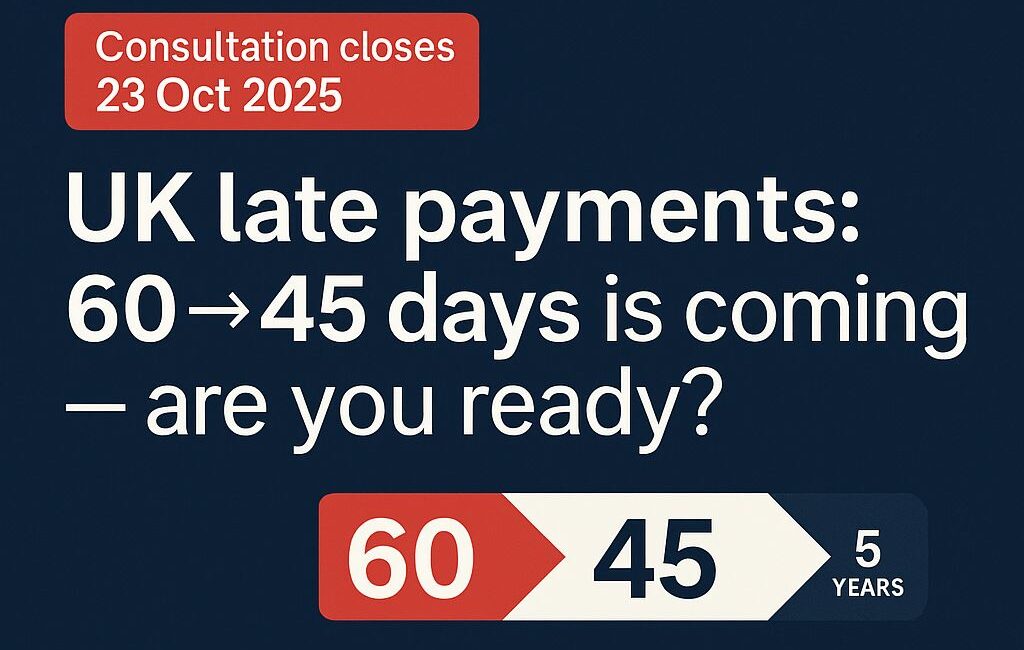

B2B contracts will be limited to 60 days, with a glide path toward 45 days within five years.- 30-day dispute deadline:

Businesses will have 30 days to raise any invoice disputes — after that, payment must be made on time.- Mandatory statutory interest:

Late payments will automatically accrue interest at Bank Rate + 8%, with no discretion to waive it.- Enhanced transparency:

Companies will be required to report statutory interest owed and paid, making the true cost of lateness visible to all stakeholders.- New enforcement powers:

The Small Business Commissioner (SBC) will be given authority to investigate and fine repeat offenders.

From 1 October 2025, suppliers seeking central government contracts will face tougher entry requirements. Bidders must demonstrate:

This will be assessed at the selection stage, meaning poor payment performance could disqualify bids before they’re even reviewed.

The reforms are more than just compliance — they’ll reshape financial operations across the UK. Here’s what to expect:

1. Days Payable Outstanding Will Compress: With a hard 60-day cap — and 45 days on the horizon — cash will flow out earlier. That means re-forecasting liquidity, updating working capital models, and revisiting covenant headroom now, not later.

2. Disputes Will Be on the Clock: A new 30-day dispute deadline means delays won’t buy time. If you don’t raise a genuine dispute within 30 days, payment must be made — and statutory interest starts accruing the day after the due date. This makes clear SLAs and invoice verification workflows essential.

3. The Cost of Lateness Goes Public: With mandatory interest and public reporting, late payments will no longer stay in the shadows. Lenders, investors and even the media will have visibility — increasing reputational and financial pressure to comply.

4. Board-Level Oversight Will Rise: Audit committees will need to scrutinise payment practices as part of governance. The SBC could be granted assurance and spot-check powers, with penalties for firms that consistently pay late (a potential 25% late-payment trigger is under discussion).

5. Reporting Will Get Tougher: Updated Duty to Report guidance (Sept 2025) introduces more granular metrics — including the value of invoices paid late, percentage disputed, and construction retentions. You’ll need to align definitions and strengthen internal controls.

Complex commercial structures will come under closer scrutiny. This includes:

Until final guidance is issued, the safest approach is to:

Audit all supplier terms and simulate how the 60-day cap (and 45-day future limit) will impact working capital. Identify contracts that exceed the threshold and begin renegotiations.

Implement a 30-day dispute process. Configure your ERP to timestamp dispute activity and auto-accrue statutory interest after due dates.

Build a Payment Practices dashboard to track invoice-level metrics — days to pay, disputes, and interest owed/paid — and brief your audit committee regularly.

The new framework outlined in the UK late payment reform will challenge traditional payment practices — but it’s also an opportunity. Businesses that act early can turn compliance into a competitive differentiator, strengthening supplier relationships, enhancing credibility with investors, and improving eligibility for government contracts.

4D Contact provide a comprehensive suite of global outsourced credit-control and debt recovery services for businesses looking to improve cash collection and build resilience and financial stability:

Contact us now at sales@4dcontact.com or +44 (0)20 3773 7854

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide