White-label Debt Collection: An Introduction

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Richard Brown

Read it in 4 minutes

1200

627

1200

627

Written by Richard Brown

Read it in 4 minutes

Richard Brown

Written by Director of International Debt Recovery & Credit-Control provider 4D Contact, Richard has over 25 years of experience helping global businesses optimise the efficiency of their credit and collections processes to meet commercial objectives.

8 July 2020

“A white-label debt collection service is when one company delivers debt collection or credit-management services on behalf of a client or partner using their name and brand. This gives the clients customers the appearance of the debt collection and credit management services being carried out in-house rather than having been outsourced to an external agency.”

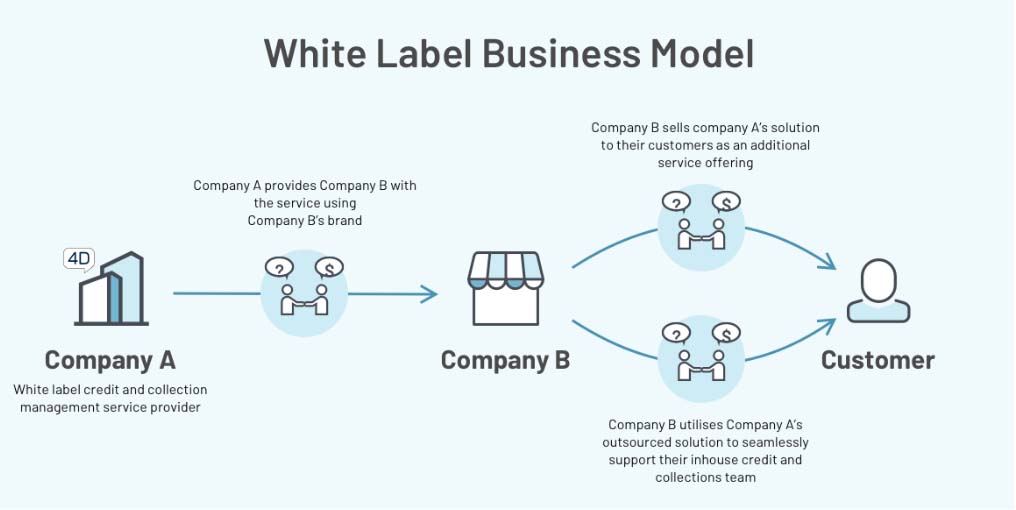

Here’s an image to explain:

As per the above diagram, white-label debt collection and credit management services provide law firms with two opportunities to improve their profit margins:

Most partners have been at a board meeting where there have been uncomfortable discussions regarding the firm’s current lock-up levels. Indeed, with lock-up often ranging between 10-20% of total billed revenues it is unsurprising this can lead to some heated debate. As a business providing legal services, some level of lock-up – tied-up in revenues yet to billed – will always be unavoidable. However, if a large percentage of the lock-up bucket is formed from overdue invoices, questions must be raised regarding the effectiveness of the business’ credit and collections policies and procedures.

For many businesses credit management and recovering debts can be time-consuming, expensive and inefficient – which is why businesses of all sizes often look to outsource these processes to an external agency. Through leveraging a specialist agency’s wealth of expertise and resources you can improve the efficiency and effectiveness of your collections, reduce costs and free up your client services and finance teams to focus on the areas where they can really add value.

If this is done utilising a white-labelled resource, which provides a high-quality bespoke credit management service in the tone and pace which fits your business and brand as your brand, this can not only prove seamless to your clients but often deliver them a far stronger customer experience. Access to a flexible, scalable resource can ensure issues and disputes are swiftly identified and resolved, removing any barriers to pay and reinforcing your business as efficient and effective in all areas that your customers touch.

It is usual for law firms who have delivered their commercial clients a great service to go on to secure work on other parts of the business – this optimization of revenues from each customer can be critical to business growth. However, whilst debt recovery work can prove lucrative, this piece of the corporate legal pie can often prove more difficult to secure with many business either handling much of this in house, utilising specialist firms, or in relationships with credit and collections agencies who have their own preferred legal partners.

A white-labelled partnership allows you to offer your clients a full debt recovery service under your branding from pre-legal through to the back-end litigation without the financial risk of having to invest in building an in-house team.

Positioning yourself as a one-stop shop for all your customers debt recovery needs can deliver the business:

With a white-labelled partnership, this can be achieved on a no-risk basis with no need to invest in human and logistical resources and is easily scalable up and down to service those peaks, or indeed troughs with no lost expenses.

If you would like more information regarding white-labelled debt collection services and what they could deliver for your business, please drop us an email to business@4dcontact.com

Text written by Richard Brown

CRO of Global Debt Recovery & Customer Contact provider 4D Contact, Richard has over 20 years of experience helping global businesses, across multiple verticals, optimise the efficiency of their credit and collections processes to meet business objectives.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide