Three key factors for optimising cash collection

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Mark Smith

Read it in 3 minutes

1200

627

1200

627

Written by Mark Smith

Read it in 3 minutes

Mark Smith

Written by Director of International Debt Recovery & Credit-Control provider 4D Contact, Mark is an invoice-to-cash process expert. He specialises in working in partnership with his clients to build and deliver bespoke solutions which secure cash targets and their customers an outstanding experience.

16 September 2022

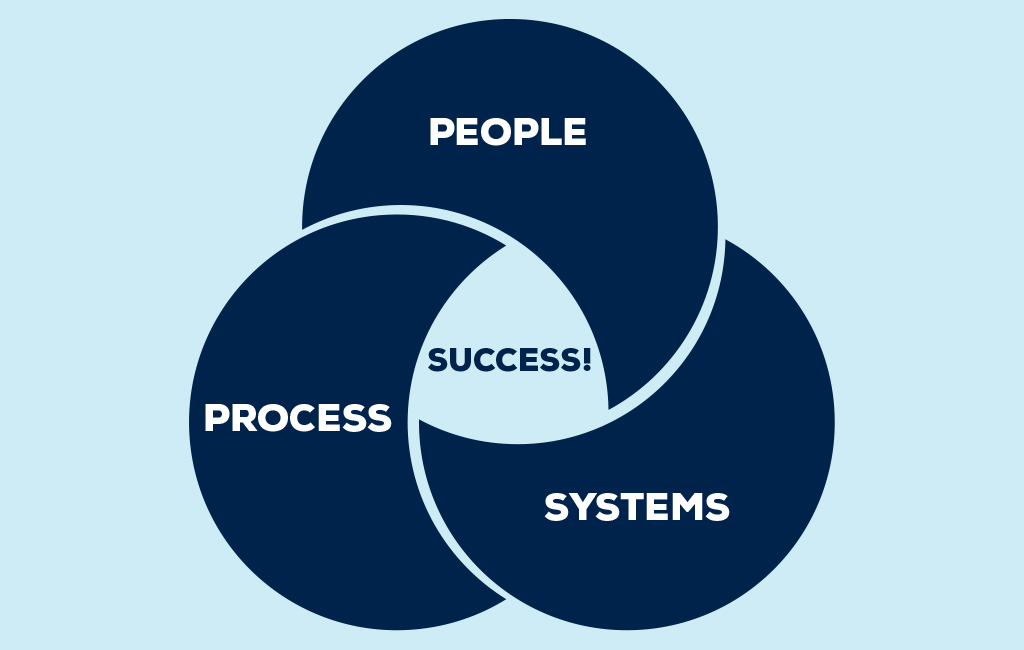

Effective credit management is when the three key factors critical for optimising cash collection – systems – processes and people – are delivered successfully.

So many articles are written highlighting multiple key factors for optimising cash collection – you’ll find one or two within our own insights section! These usually outline 6 or more factors which can evidenced as impacting your cash collection – from the need for accurate billing, to facilitating ease of payment, delivering fast dispute resolution and leveraging the efficiency delivered by intelligent workflows.

However, a recent LinkedIn post by Ragaei Nasr, Director of Credit Collections at Otis Elevator Co highlighted that at the core there are only three key factors which ensure successful cash collection: systems, processes, and people. Optimised cash collection is the sweet point when all three are delivered successfully.

Without doubt one of the biggest advances in credit and collections process has been digital transformation. Technological developments within order-to-cash have provided transparency, real-time intelligence, and data-based insight across legacy processes which was previously inaccessible. This data insight has enabled the development of intelligent workflows as well as the automation of repetitive tasks which have dramatically improved the effectiveness of collections processes. It is arguable that businesses that fail to transform and implement the right systems will be left behind.

Digital transformation has been critical in terms of providing new insight to ensure the optimisation of process. However, it is important to note that it is how systems can help improve process which makes it such a key piece in the collections puzzle. Effective and efficient processes are critical to optimising cash collection and modern collections software solutions provide the data insight to reach new levels of efficiency and effectiveness within the collections process. Without process, a collections software system would be a data repository.

However, to quote Ragaei Nasr “You can have all the advanced systems in the world, in addition to defining all the processes and policies, yet you may fail!! The reason is simple … you don’t have the right people.”

You can put in the best systems in the world, build the most efficient and effective processes but if people don’t use them in the right way they will not deliver. At 4D Contact we work with many companies who have integrated an O2C software system only to see it fail to deliver the results expected due to issues with employee engagement. However, put our team on the system, using it correctly, and the results follow.

Effective credit management is when the three factors critical for optimising cash collection – systems – processes and people – are delivered successfully.

Author: Mark Smith

Director of outsourced credit management solutions providers Barratt Smith and Brown and 4D Contact, and a major share-holder in fintech company Invevo, Mark has over 30 years of experience providing clients build strategic process solutions to mitigate challenging financial markets.

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide