An overview of how debt collection limitation periods vary across Europe

If you are pursuing a cross-border debt it is critical you understand the debt collection limitation period for the country from which you are trying to collect your debt otherwise your right to claim could have expired before you choose to start debt collection proceedings. This guide provides an overview to the debt collection limitation periods across Europe and what action you can take to prevent them expiring.

What is a statute of limitation / debt collection limitation period?

In regard to debt collection, a statute of limitations or limitation period refers to the time creditors /debt collectors have to legally chase a debt for recovery before their right to claim expires.

The purpose of having a limitation period is to prevent charges from being raised that date so far back into the past that defence against the charges is difficult and expensive. Evidence might be difficult to obtain, testimony may be clouded, and the defendant may not receive a fair trial.

.

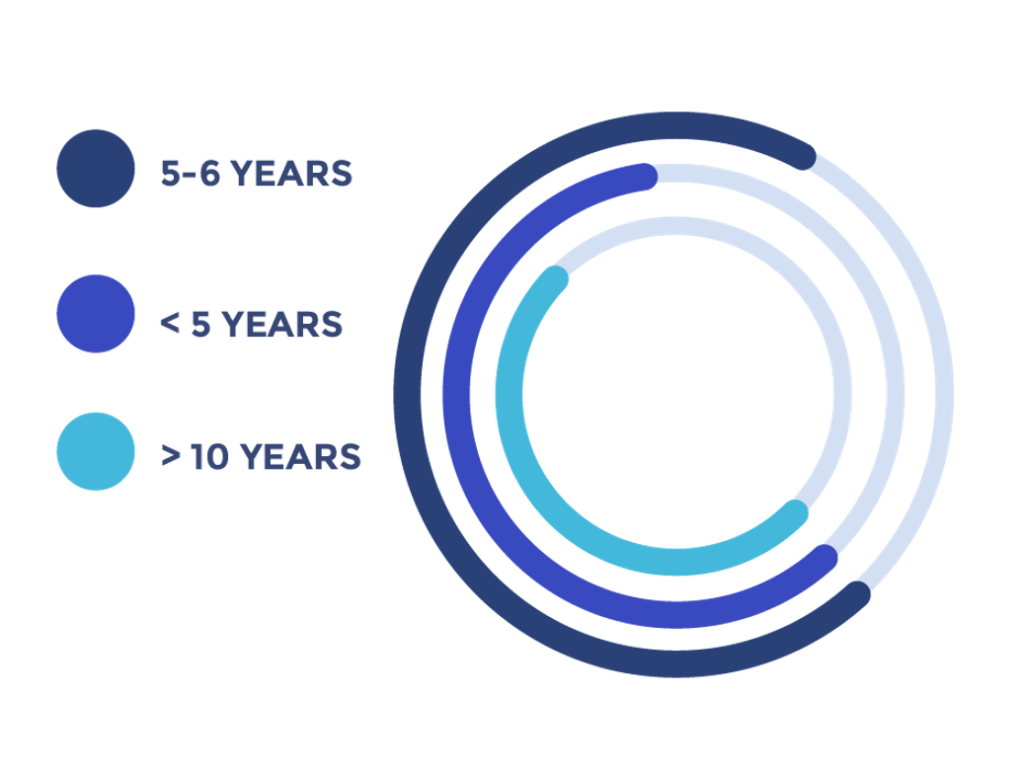

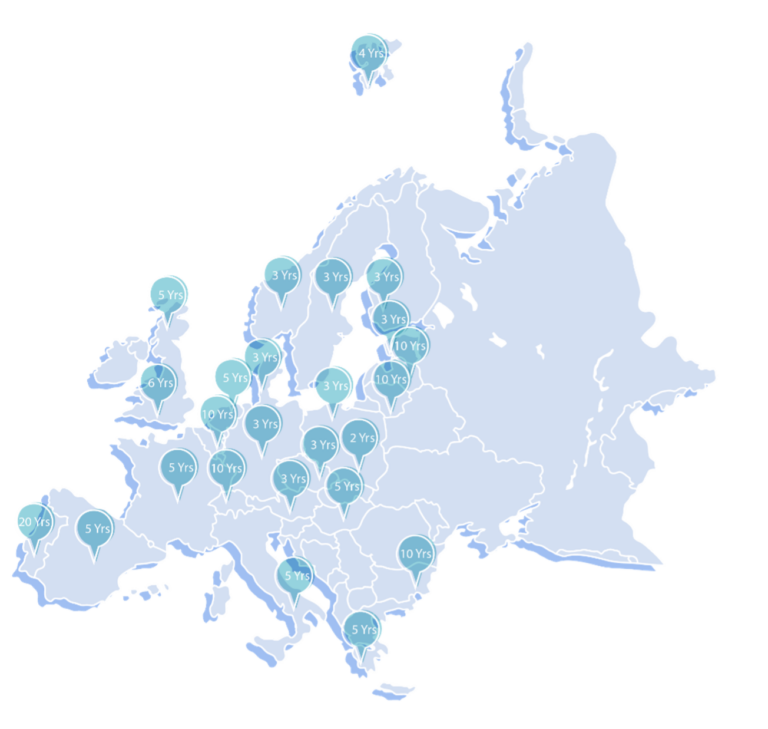

In Europe, limitations periods can vary greatly depending on the nature of the breach of contract / type of debt, and on the individual laws of each country, although as per the diagram to the left, the limitation period for claims of commercial debts typically ranges from between 3 and 10 years with either 5 or 6 years the most common limitation period.

Northern countries such as Germany Sweden, Norway, Poland have lower limitation periods, however interruption options are easier to prove. Whilst countries with longer limitation periods such as Portugal, Luxembourg, Lithuania, Turkey tend to have more complicated interruption options

When the limitation period begins also varies from country to country. Some countries start the count down from the moment the debt is due while others will apply at the end of the natural year.

Is it possible to prevent a limitation period from expiring?

Once the limitation period is running, a simple contract debt will normally be statute-barred at the end of the limitation period. However, it is possible to prevent your invoice from expiring by interrupting the limitation period. The interruption stops and resets the limitation period. In general, there are 4 ways to interrupt a limitation period:

- A claim filed in court

- A burofax (a type of registered letter) from or to the debtor confirming the existence of an outstanding invoice.

- A payment has been made towards the debt during the limitations period

- Written correspondence from the debtor to the creditor confirming the existence of an outstanding invoice

In some countries like France a Subpoena is also a valid legal document. One or more of these actions would count as interruption to the limitation period, which enables the limitation period to be extended for the same term, commencing from the date of the last action. It is therefore most profitable to send the letter of suspension at the end of the limitation period.

Conclusion

How you proceed in collecting a debt from a country in Europe can therefore vary greatly depending on where the creditor and debtor are located. But whether the debt falls within EU jurisdiction or outside there are multiple options to ensure you can collect what is owed. But whether your debt is within the EU or outside it is definitely worth bringing in some external expertise to help support you through the debt collection process. When chasing late payments, it is difficult enough to deal with customers in your own country, let alone navigate the complexities of different languages, laws, payment regulations and customs.

Author: Richard Brown

International debt collection and credit management experts, 4D Contact have over 30 years of experience in helping global, blue chip companies collect what is owed throughout the world. With offices both within and outside the EU, 4D Contact are ideally positioned to support you with your European collections.

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

Interested in receiving more news and views from 4D Contact?

Subscribe to our weekly newsletter