The International Monetary Fund forecast global growth in 2022 at 4.4%, but these projections are being revised downwards as inflation and the fallout from the Ukraine conflict ripple across global markets. The Organization for Economic Cooperation and Development (OECD) also reduced its first quarter GDP quarter on quarter to zero or negative for most of the G7 economies. With low level growth, high-level inflation, and the no apparent end in sight to the Ukraine crisis economic volatility is increasing and there are now serious concerns several G7 economies are heading for recession.

Impact of the Ukraine Crisis

Although the war in the Ukraine was underway prior to the previous IMF economic growth projections, and there was understanding there would be economic consequences, it was impossible to predict their length and breadth. As the war has unfolded these consequences have been far-reaching and compounded already tightening financial conditions.

“We all knew from day one that this war was bad economic news – less growth and more inflation. And this is a price we accepted together to pay to protect our values, to be at the side of Ukraine and democracy.”

François Villeroy de Galhau, Governor, Central Bank of France

The impact of the war on energy costs which were already skyrocketing has been well-documented. Fuel and energy costs are at unforeseen levels with UK household expecting to see a 50% increase on their energy bills in 2022. This is driving a rising cost of living crisis for many UK & European households. However, the greater concern is the shock on other commodity prices – particularly food. The impact of the war in the Ukraine on the food supply has caught the world by surprise. With food prices continuing to rise exponentially there is growing anxiety across the globe about securing access to food at a reasonable price.

Inflation

Without a doubt the greatest driver of volatility in the global economy at present is global inflation. It is generally believed that its origin was the Covid economic stimulus packages in the US and Europe – and that governments were naïve to think you could stimulate the economy to such an extent and not see inflation. However, it is long-tail Covid supply chain issues and the Russian – Ukraine conflict are driving current cost and price increases and fueling inflation further. It is a perfect storm and what was initially thought to be a transitory issue, is now the key focus on government economic policy across the globe.

The US has a very clear strategy – with interest rate rises of 75 basis points last week and further raises expected to be made at the next Federal Open Market Committee meeting . Europe is less specific about immediate rate rises but speaks of a clear road map.

“I would play down the idea of a short-term trade-off between inflation and growth. In the short run, our priority is clearly fighting inflation, and we will do it.”

François Villeroy de Galhau, Governor, Central Bank of France

Risk of Recession

There is mixed opinion amongst economists whether the volatility in the economy will turn into global recession. The IMF revised forecast still predicts global growth to be 3.6%. However, there is consensus that some countries that haven’t recovered from the COVID-induced crisis, are generally weaker economically or are highly dependent on imports from Russia or Ukraine for energy or imports of food, could be at risk. There are also predications that a European directive to abandon Russian oil and gas at this stage could potentially drive Europe into recession. However, there is also optimism, whilst activity is less buoyant than at the end of last year there was still growth in the euro area of more than 5% in Q1 of 2022 – a long way off recession.

Covid Debt Crisis

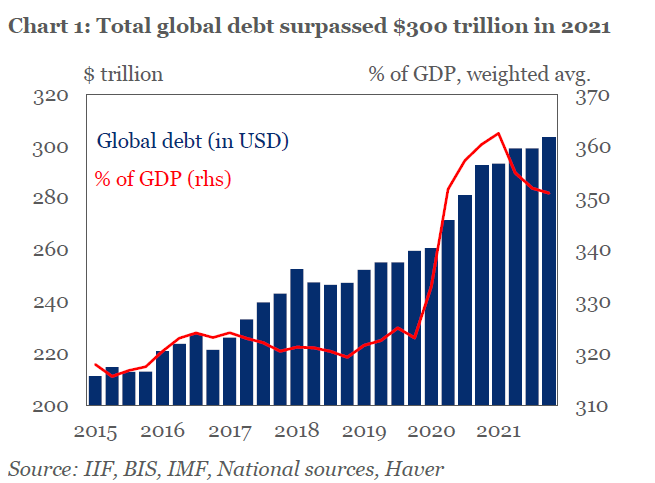

Although Covid was an exceptional circumstance which called for exceptional policies and action, questions need to be asked why governments did not consider the inflation risk of the stimulus packages. The increased government borrowing required to support Covid stimulus packages, followed by inflation and interest rates rises to help correct it is the stuff of economic nightmares. The US is already spending over 7% of their federal government budget on interest and Europe, which pre-Covid was on negative interest, now has a positive cost.

Many economists consider this to be potentially the greatest economic risk for the future. Governments cannot afford to keep on increasing national debt with no thought for the consequences. Alternative means of private resourcing and funding must be found if economic stability is to be secured.

Securing Supply Chains & The Green Energy Transition

And further investment is required. Covid and the Ukraine-Russian crisis have highlighted vulnerability of existing supply chain infrastructures. It is imperative we establish new “shock resistant” global supply chains. Equally important is maintaining the impetus of the green energy revolution which the Russian-Ukraine crisis has now highlighted to be imperative as both an economic as well as environmental issue.

Conclusion

Without question 2022 will be characterised by volatility in the global economy. Although most countries are positioned to be resilient there will be losers. Those nations which were less economically secure, struggled under Covid and are now impacted by the Ukraine crisis will feel the pinch. Recession is a real possibility, but it should be fragmented and relatively low level.

There is optimism that we will see many of the supply chain issues and demand imbalances on commodities ease within the not-too-distant future. However, the geopolitical and other issues are more difficult to predict. Governments can make monetary policy to try to curb inflation, but it comes with no guarantee of success. It also has the potential risk of over or undershooting.

One thing is certain securing future resilience must be top of government policy making, from re-imaging supply chains, to addressing climate change, to pandemic planning, and the economy. We need more long term policies and long term planning.

Author: Mark Smith

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

Interested in receiving more news and views from 4D Contact?

Subscribe to our weekly newsletter