The 2022 European economic outlook is optimistic with the economy demonstrating a strong rebound from pandemic. The effective delivery of vaccination programs and the subsequent easing of pandemic restrictions have led to strong growth in most markets. However, this forecast is not without significant challenges and risks – many of which will be further impacted by the ongoing crisis in the Ukraine. Businesses are going to have to position themselves carefully to ensure they have the resilience to weather these challenges and deliver growth.

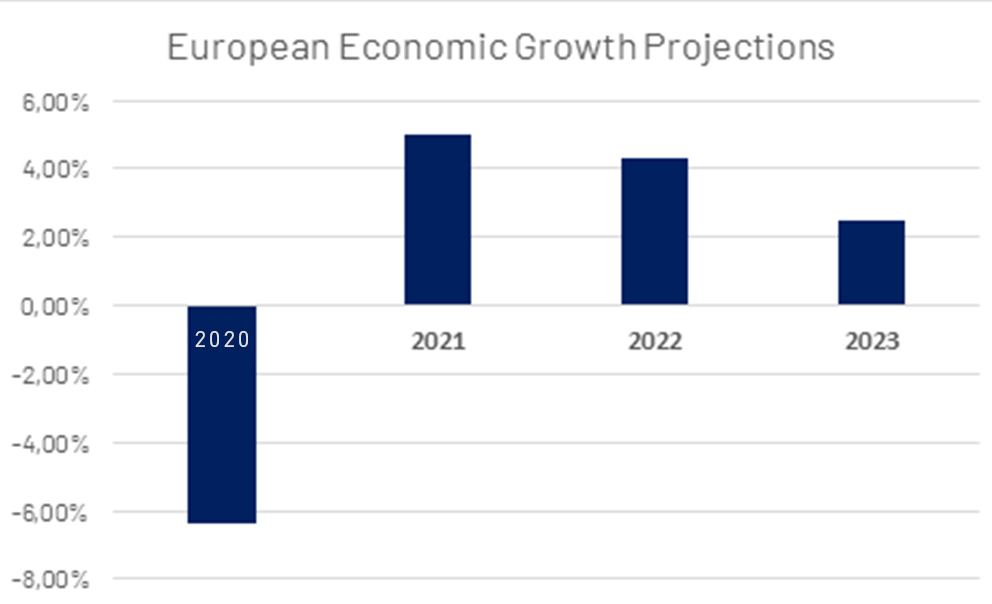

2022 Growth Projections

2021 saw strong recovery for Europe as people responded to the relaxation of lockdown measures from Spring with a spending spree, with by summer the EU economy regaining its pre-pandemic output. The EU Commission’s growth projections for 2022 – 2023 very much reflect the global outlook with strong recovery forecast both in the Eurozone and overall EU.

However, the 2022 European Economic outlook is far from certain and will be dependent on the outcome / response to the short, medium and long-term challenges of:

1. Rising inflation

Latest estimates put inflation for the Euro area at 7.5 % in March 2022, up from 5.9 % in February 2022.

As of December 2021, the inflation rate in the European Union was 5.3 percent – higher than at any other time. There are significant differences by country ranging from 5.7% in Germany, to 3.4% in France to over 12% in Estonia. Soaring energy bills have been by far the biggest driver with costs increasing 25.9 percent year-on-year. However, the price rises seen in food, alcohol, and tobacco across most countries highlight the broadening base to inflation.

There is confidence that the current levels of inflation will be a short-term phenomenon which will subside as supply difficulties and energy pressures will gradually correct over the course of the year. However, the ongoing situation in the Ukraine is adding to the energy uncertainty and governments and the ECB are going to need to act decisively to bring inflation under control and prevent a European cost of living crisis. To quote Bank of France Governor and European Central Bank Governing Council member François Villeroy de Galhau:

The ECB remains very vigilant about prices and wages dynamics, and will gradually adjust its monetary policy to firmly ensure that inflation recedes soon and then stabilises around its 2% target over the medium term.

François Villeroy de Galhau speaking at the World Economic Forum

2. The Continued Dynamics of the Pandemic

As we enter 2022, there is growing acceptance that Covid-19 is here to stay. The question is no longer about containment but control as governments try to balance health and economic risks. Whilst this has brought optimism to the 2022 European Economic Outlook – with global growth forecast to return to pre-pandemic levels in the next few years – it is with a high level of uncertainty.

It is essential to achieve high level of vaccinations across all parts of Europe if the immergence of new vaccine resistant strains of the virus is to be prevented. However, vaccination rates are not even across all territories. As of February 17, 2022, 94.5 percent of adults in Ireland had been fully vaccinated against COVID-19. On the other hand, only 34.7 percent of adults in Bulgaria had been fully vaccinated.

This combined with the spread of the highly contagious Omicron variant has led to rising infection rates across the continent that could pose a threat to continued recovery. As of 18th Febuary 2022 an epidemiological situation of high or very high concern was observed in 25 EU/EEA Member States. However, it is important to note that considerable differences remain between countries and at present the overall picture appears to be improving, with fewer countries classified as of very high concern compared to the previous week.

3. Rising Energy Costs

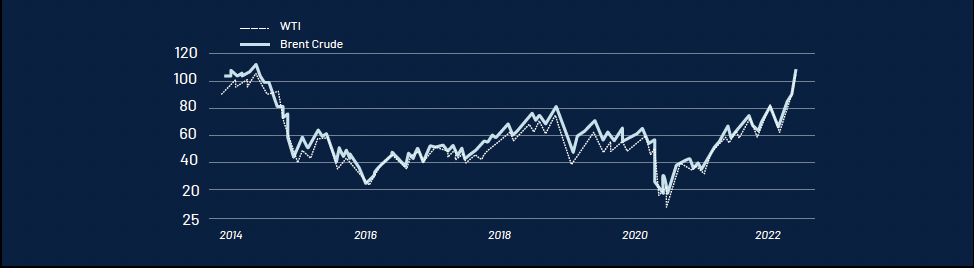

Energy prices across Europe have sky-rocketed over the past year. Low gas storage levels, high European Union carbon prices, fewer liquefied natural gas tanker deliveries due to higher demand from Asia, lower than normal Russian gas supplies and infrastructure outages have created a perfect storm driving a global surge in wholesale power and gas prices – up 300% on last year.

Brent crude and WTI oil price over 100 $ ,the highest since 2014

The unfolding Ukraine crisis could lead to even greater price increases. With Europe securing nearly 50% of its gas from Russia, if Putin chooses to weaponize energy at the cost of an already unstable Russian economy, there could be exceedingly tough times ahead for gas dependant European households.

The EU Commission has outlined measures national governments can take and said Brussels would investigate longer-term options to address price shocks. Meanwhile governments have already announced measures such as subsidies, removing environmental levies or VAT from bills and price caps.

However, it is without question that these price rises will be felt both in household running costs and the cost of goods – as businesses are forced to rise prices to maintain profit margins in the face of rising costs.

4. Climate Change

Climate change will present European businesses with challenges and opportunities as the global commitment to stop rising temperatures agreed at COP26 filters down to businesses across the globe. However, since Paris, most businesses have seen the COP26 agreements on the horizon and have started independent initiatives to reduce greenhouse gas emissions ahead of legislation. There is growing understanding that those who aren’t prepared will be left behind.

“Net zero is the next industrial revolution. And like other revolutions, those businesses who seize the opportunity can expect to thrive – those that don’t may not.”

KPMG : COP26 reflections: Implications for businesses

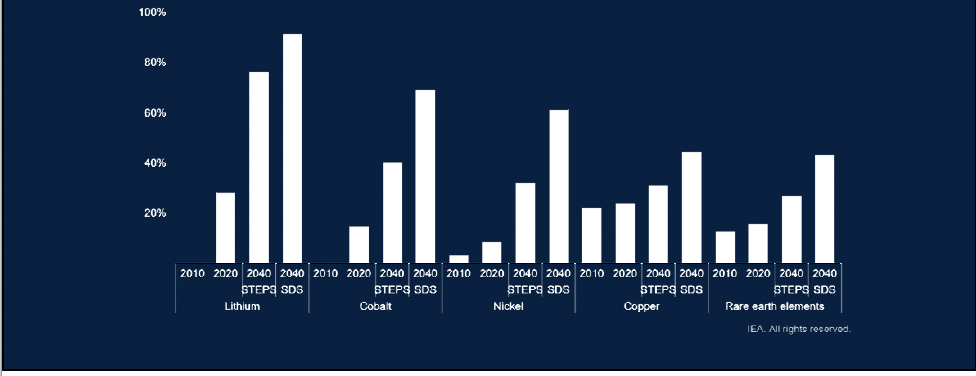

Many businesses will need to invest in new production techniques / business processes to reduce carbon emissions and meet climate change targets. A global shift to greener energy will also drive increased demand on the metal commodities which are essential for green energy transition with copper, nickel, cobalt, and lithium all key to green energy technologies. Whilst demand will lead to growth opportunities for countries which have the highest level of production and reserves, this could also lead to rising prices and production costs for corporations which also need access to the same raw materials.

Share of clean energy technologies in total demand for selected minerals

“net-zero commitments are outpacing the formation of supply chains, market mechanisms, financing models, and other solutions and structures needed to smooth the world’s decarbonization pathway.

For businesses, these conditions will create opportunities to innovate and to lead coordinated action by industry peers, value-chain partners, capital providers, and policy makers. They also introduce added risk that commodity prices will spike.”

MCKinsey.com: COP26 made net zero a core principle for business. Here’s how leaders can act

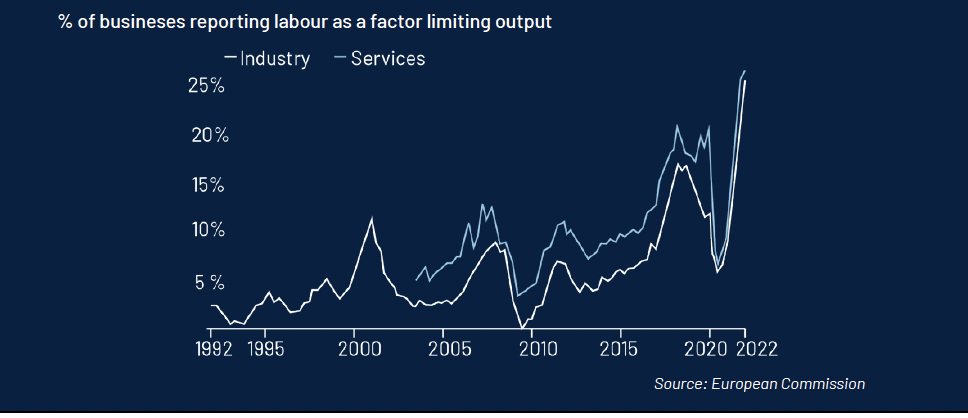

4. Labour Shortages

As well as the above global challenges, Europe is also facing a growing labour challenge which poses a significant threat to the 2022 Economic Outlook. There are staff shortages appearing across multiple sectors since the pandemic. The deficit of staff has broadened from the rapidly expanding high-paying IT and digital industries to include lower skilled sectors such as tourism, hospitality, logistics, delivery, and construction.

Eurozone businesses are facing unprecedented labour shortages

The causes vary by country, but the across the board the key driver has been the ongoing impact of the Covid-19 pandemic. Furlough benefits and part-time work schemes have been a contributing factor in some European countries. Whilst border closures and travel restrictions have disrupted the flow of seasonal and migrant workers into countries who have historically relied on these to fill vacancies. Across Europe, many migrant workers returned home to be with family and friends during the pandemic.

However, post pandemic other factors are also at play including the growing strength of Central European economies including Poland, the Czech Republic, Hungary and Slovakia. With wages rising and unemployment falling, this has led to many workers who returned home during the pandemic choosing to stay, as well as limiting the desire of other workers to move in search of employment. This is thought to have been a major contributing factor to the shortages of lorry-drivers throughout European.

The pandemic has also driven a seismic readjustment to people’s approach to the work-life balance. Lockdown gave people an insight into a different way of life and many are now rethinking the distances they are willing to commute, the hours they work and the kind of jobs they are willing to take.

Conclusion

Whilst the 2022 European economic outlook is promising, it is not without significant challenges and risks. To quote Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People:

“The European economy is bouncing back strongly from the recession, with a projected growth rate of 5% this year. Our measures to cushion the blow of the pandemic and to ramp up vaccinations across the EU have clearly contributed to this success. But this is no time for complacency: we continue to face uncertainty with this virus and there are some risks to contend with. Not least, we need to address bottlenecks in supply chains, as well as surging energy prices which will affect many households and companies across Europe. We also need to closely monitor inflation and adjust our policies if needed.”

European Commission: Autumn 2021 Economic Forecast: From

recovery to expansion, amid headwinds

Author: Mark Smith

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

Interested in receiving more news and views from 4D Contact?

Subscribe to our weekly newsletter

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-digital-transformation-1.png)

Download our eBook

A C-Suite executive’s guide to Delivering successful order-to-cash transformation

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download