How good cash management will be critical for businesses to thrive in an inflationary market place.

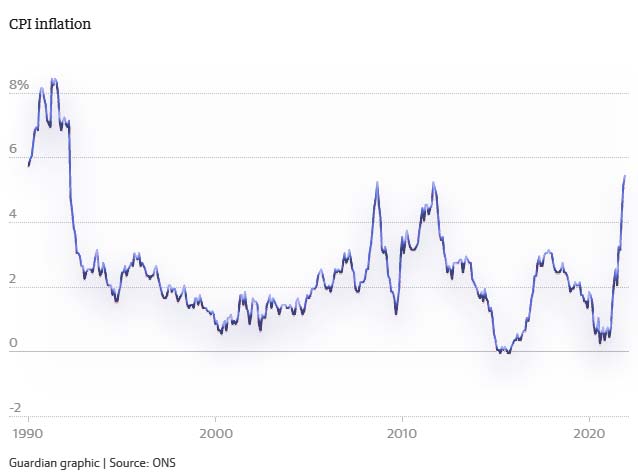

UK inflation has risen to its highest level in 30 years – reaching 5.4% and mirroring what is fast emerging to be global inflation crisis. This article looks at how rising inflation is impacting businesses and how good cash management strategies will be critical to ensure businesses are in the best possible position to weather the inflation storm.

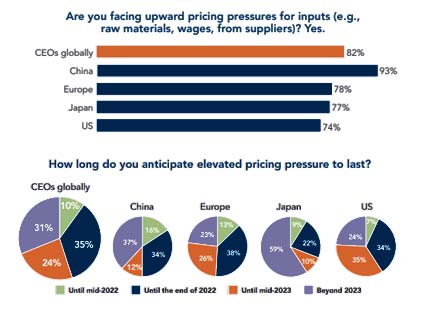

Although there are nuances country by country, high demand, rising raw material and energy costs and a challenging employment marketplace are the over-arching factors driving the rises in inflation – all ongoing consequences of the Covid-19 pandemic. With no easing of these pressures on the short-term horizon, and with energy and gas costs predicted to remain high until mid 2023, inflation rates look set to remain high for the foreseeable future.

It is therefore not surprising that in a recent survey by , C-Suite executives rated inflation as their second greatest external threat after pandemic. Whilst a survey of 5,500 UK businesses by the British Chamber of commerce highlighted how one in four business are concerned about interest rates rising, and a staggering three in five businesses were expecting their prices to increase in the next three months.

With rising raw material costs, higher energy prices, the reversal of the VAT reduction for hospitality and the need to increase wages to secure staff, businesses will have to make some tough decisions on how to manage the impact of rising input costs on profit margins. The options available to CEO’s are limited, reducing costs – both for inputs and business management or passing increases on to consumers. Corporations can also accept reduced profit margins – but this will put the business under increased pressure to secure volume growth to maintain its current revenue position let alone demonstrate growth.

One thing is certain within an inflationary marketplace, no one wants to be sitting on cash on the balance sheet which is ever devaluing. As many businesses learnt during the pandemic, in an uncertain economic environment cash flow is king, and cash on the balance sheet is not of the same value as cash in the bank. It will therefore be critical that businesses make optimising their cash management an absolute priority. Ageing ledgers need to be amortised swiftly and processes reviewed to ensure average DSO is running at the shortest length possible.

It is critical to remember this all needs to be done when everyone else will also be looking to optimise their cashflow and therefore delay paying when possible. This is when it is important to remember the old credit-control adage that ‘he who shouts loudest gets paid first’. Proactive credit-control and debt collection will be critical to keep cash flow moving.

If your inhouse team is already working at full capacity this could be the time to look at an outsourced solution to provide flexible and scalable support. Results-driven, they can usually be working your ledgers within days rather than the weeks or months it takes to train and recruit staff. For credit control the costs are often significantly lower than increasing inhouse headcount, whilst for debt collection they usually work on a contingency only basis.

Conclusion

Some inflationary pressures are specifically linked to pandemic disruptions and may start to abate once the long-tail effects of the pandemic subside. However, there are also other drivers of higher inflation that could be potentially more enduring. The move towards greener energy is likely to create increased demand on key metals which will drive price increases, whilst the supply chain issues re energy and semi-conductors do not look like they will be resolved in the short-term.

The longer inflation remains high the greater the risk of further inflation. As businesses raise prices and wages to off-set increasing costs, inflation becomes a self-fulling prophecy. Central banks will therefore be under pressure to make interventions to curb inflation – usually in the form of raising interest rates. This is turn brings risks in the form of curbing growth and weakening the economic recovery from the pandemic.

It is without question that in 2022 CFO’s across the globe need to ensure their businesses are in the best possible financial position to ensure they have the resilience to survive and thrive in a highly challenging economic market place.

Author: Mark Smith

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

Interested in receiving more news and views from 4D Contact?

Subscribe to our weekly newsletter

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-digital-transformation-1.png)

Download our eBook

A C-Suite executive’s guide to Delivering successful order-to-cash transformation

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download